9 Simple Techniques For San Diego Home Insurance

9 Simple Techniques For San Diego Home Insurance

Blog Article

Protect Your Home and Possessions With Comprehensive Home Insurance Policy Coverage

Recognizing Home Insurance Policy Insurance Coverage

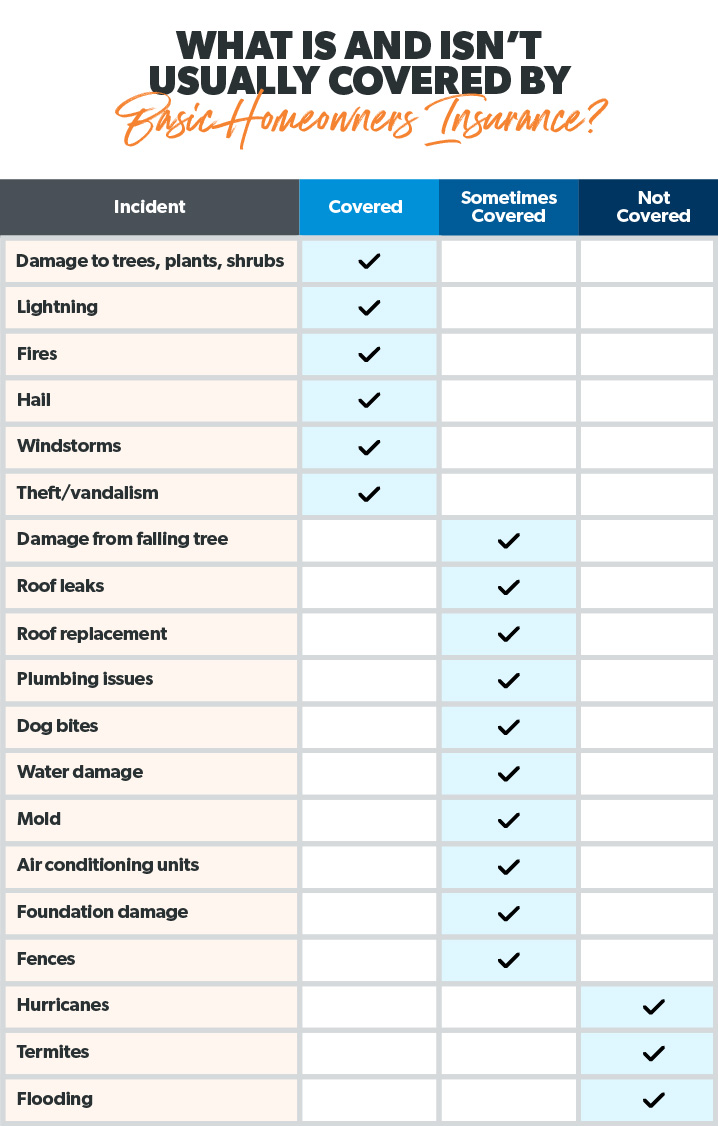

Understanding Home Insurance coverage Coverage is essential for homeowners to shield their building and possessions in case of unforeseen occasions. Home insurance policy generally covers damages to the physical framework of your home, personal valuables, liability security, and additional living expenses in the occasion of a covered loss - San Diego Home Insurance. It is vital for homeowners to comprehend the specifics of their policy, including what is covered and omitted, policy restrictions, deductibles, and any type of extra endorsements or cyclists that might be needed based upon their private circumstances

One secret element of recognizing home insurance protection is recognizing the difference in between real cash worth (ACV) and replacement expense coverage. House owners ought to additionally be mindful of any type of protection limitations, such as for high-value things like jewelry or artwork, and think about buying added insurance coverage if necessary.

Benefits of Comprehensive Policies

When checking out home insurance protection, property owners can obtain a deeper admiration for the protection and peace of mind that comes with extensive plans. Comprehensive home insurance plans use a wide range of advantages that go beyond standard coverage.

Additionally, comprehensive policies frequently include coverage for obligation, supplying protection in instance someone is hurt on the residential or commercial property and holds the homeowner responsible. This obligation coverage can help cover legal expenditures and medical expenses, providing additional tranquility of mind for home owners. Moreover, detailed policies may likewise use additional living expenditures insurance coverage, which can help pay for short-term housing and other needed expenses if the home ends up being unliveable because of a covered event. In general, the thorough nature of these plans provides house owners with robust security and economic security in numerous scenarios, making them a valuable investment for securing one's home and assets.

Customizing Coverage to Your Needs

Customizing your home insurance policy coverage to straighten with your specific requirements and conditions makes sure a effective and tailored guarding published here approach for your residential property and possessions. Tailoring your coverage permits you to attend to the special aspects of your home and possessions, providing a much more detailed guard against possible risks. Inevitably, customizing your home insurance coverage offers peace of mind understanding that your assets are secured according to your one-of-a-kind scenario.

Safeguarding High-Value Possessions

To adequately shield high-value assets within your home, it is vital to examine their worth and consider specialized coverage alternatives that accommodate their one-of-a-kind value and relevance. High-value assets such as art, precious jewelry, vintages, and antiques may exceed the insurance coverage restrictions of a standard home insurance policy. It is important to work with your insurance coverage supplier to ensure these products are adequately shielded.

One means to protect high-value possessions is by arranging a different plan or recommendation specifically for these products. This customized protection can offer greater coverage restrictions and may additionally include added defenses such as insurance coverage for accidental damages or mysterious loss.

In addition, before acquiring insurance coverage for high-value possessions, it is recommended to have these items properly assessed to establish their current market price. This assessment documents can aid improve the insurance claims procedure in case of a loss and ensure that you obtain the appropriate repayment to replace or repair your useful belongings. By taking these positive steps, you can delight in tranquility of mind knowing that your high-value properties are well-protected versus unexpected conditions.

Insurance Claims Refine and Policy Monitoring

Conclusion

Finally, it is vital to guarantee your home and assets are sufficiently safeguarded with detailed home insurance policy protection. By understanding the insurance coverage choices readily available, tailoring your policy to satisfy your specific requirements, and safeguarding high-value assets, you can alleviate risks and potential financial losses. Additionally, being familiar with the insurance claims process and properly managing your policy can help you browse any kind of unanticipated occasions that might occur (San Diego Home Insurance). It is essential to prioritize the defense of your home and possessions through comprehensive insurance protection.

One trick element of recognizing home insurance protection is understanding the difference in between real cash web link money worth (ACV) and replacement expense protection. Homeowners need to also be mindful of any type of coverage limits, such as for high-value items like fashion jewelry or artwork, and take into consideration buying added coverage if necessary.When checking out home insurance policy coverage, homeowners can get a much deeper appreciation for the security and peace of mind that comes with extensive policies. High-value possessions such as fine art, fashion jewelry, vintages, and collectibles might surpass the protection limits of a standard home insurance coverage plan.In conclusion, it is crucial to ensure your home and possessions are effectively shielded with comprehensive home insurance policy coverage.

Report this page